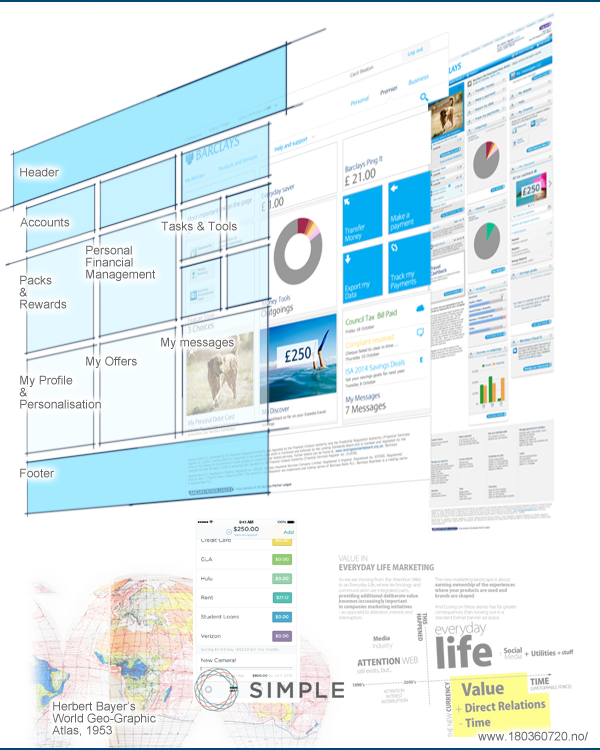

I wish I had run more workshops at Barclays, as its a great way to get inside the teams head, and where their thinking is. These are my notes from a workshop I ran in January 2014. It is also just to enjoy ‘thinking work’. Denkarbeit. The team spend so much time creating material I wonder when they have time just to think broadly about banking as an experience.

Customers will believe in the change only once the brand promise becomes tangible for them through real-life experience. Once they realise the bank thinks and acts from a customer perspective, they are likely to acknowledge it by purchasing more banking products and recommending them to others.

Apply a systematic process aimed at shaping customer touch points – customer service or product offerings, particularly – to ensure the brand can be experienced at each of them

Banks can apply the ‘Customer Journey’ tool, which traces the touch points a customer has with the bank throughout the entire purchasing process.

I have always felt that banking is service before commerce, and this was really brought home by the quote I found in a review of simple bank in Business Insider, which also convinced me that PFM is the future of logged in personal banking, the quote make it clear how useful it could be.

‘I also detected something of a weird psychological benefit to managing your money through Simple — where my lump sum of savings were previously sitting amidst millions of other lump sums belonging to individuals, businesses, nonprofits, and all order of money-wielding entities, it’s now sitting in a pretty little box that’s entirely my own with no outside distractions. I’m not being upsold on credit cards and loans. Simple provides a totally distraction-free snapshot of the state of your finances, and in the two short weeks I’ve been using it, I already feel like a better steward of my money.’

I Stopped Using Regular Banks For Two Weeks — And I’m Never Going Back – Dylan Love